-

&Shine Vape Cartridges: A Potent, Budget-Friendly Option from GTI

Read more: &Shine Vape Cartridges: A Potent, Budget-Friendly Option from GTIOverview &Shine is GTI’s “budget/value” cannabis brand, intended to offer potency, strain variety, and recognizable flavor profiles without the ultra-premium price tag. Their vape cartridges…

Blog Posts

-

The Future of Cannabis Vaping: Key Shifts to Watch in 2026

The cannabis vape market has been one of the fastest-evolving segments in the industry, shaped by shifting regulations, health-conscious consumers, and rapid hardware innovation. As…

-

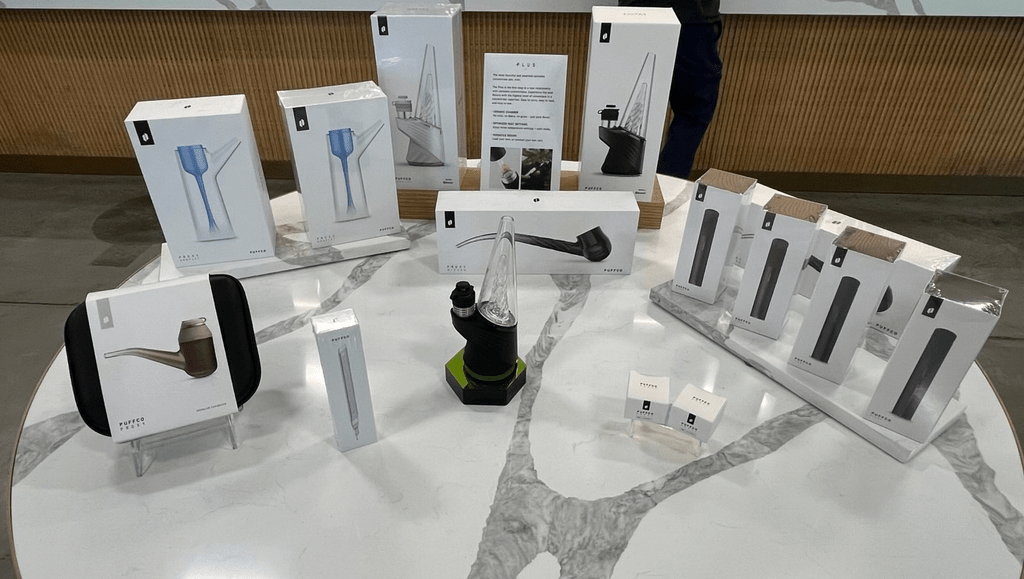

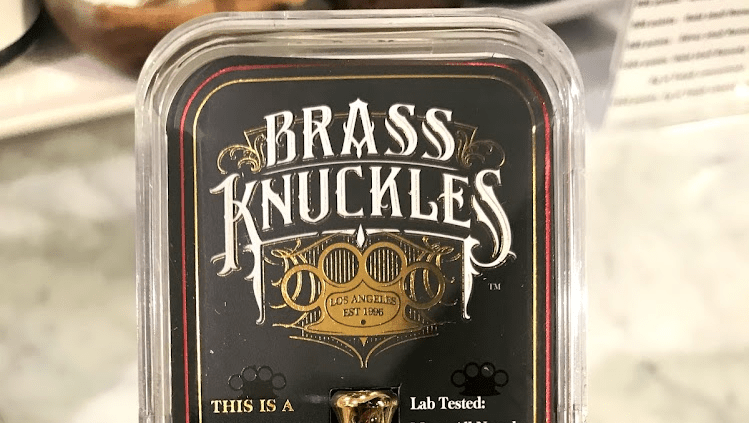

Smoke, Style, and Status: Cannabis as a Luxury Lifestyle

The cannabis industry has entered a new era, one where sleek branding and luxury positioning matter just as much as cannabinoid content. In upscale markets…

-

How Cannabis Vaping Went from Niche to Mainstream

The cannabis vaping industry has become a dominant force in both medical and recreational markets, but its rise didn’t happen overnight. The story of cannabis…